How To Find Marginal Propensity To Save

What is Marginal Propensity to Relieve (MPS)?

The marginal propensity to save (MPS) refers to the portion of additional disposable income that is saved by a consumer. The MPS for any individual reflects how much one is willing to salve, usually a fraction, for each added dollar of income.

For example, if the MPS is x%, it means that individuals save $x for every $100 earned. In Keynesian economics , economists used MPS to quantify the relationship betwixt any changes in income and saving. The term can also refer to the whole economy to show what the entire household sector does with the per centum of additional income that is saved. The slope of the saving line can be presented on a graph to analyze MPS.

Summary

- Marginal propensity to relieve (MPS) is the fraction of whatsoever additional income that consumers save rather than spend on purchases.

- MPS is not abiding but varies by income levels, with higher income showing higher MPS.

- Marginal propensity to save plays a meaning office in the Keynesian multiplier past giving insights into the potential effects of increased regime spending or investment.

Understanding Marginal Propensity to Relieve

Marginal propensity to relieve reflects of import aspects of a household'south expenditure habits since saving and consumption go manus in hand. It besides paints a movie of the saving amount from a country's economy.

Too called leakage, a saving amount is the fraction of income that is not injected back into the economy through consumption. The amount is expressed equally a percentage, and a higher proportion indicates that an private receives a higher income and hence demonstrates a greater power to satisfy their needs.

Usually, a higher income translates to a higher MPS. As people go wealthier, it becomes easier to satisfy their needs, and the boosted income earned is more likely to become into savings rather than meet household expenditures.

All the same, a higher income may change the consumption habits of an individual and may develop an increased want for luxury goods and services, such every bit high-end vehicles, amend neighborhoods, and lavish holidays.

Marginal Propensity to Save in Multiplier Effect

Marginal propensity to relieve also plays a cardinal role in determining the multiplier outcome. A multiplier measures a alter in the market value of all products produced within a country's borders, such as the Gross Domestic Production (Gdp) . It results from a change in the democratic variable, such as government expenditure.

A change in the production process creates a multiplier effect because it creates an additional dispensable income that is spent on consumption. The new consumption creates an income for another sector in the economic system, which triggers more consumption and a further alter in the production procedure.

The bike continues leading to a magnified and multiplied change in maximum output. The spending multiplier is expressed as the changed of MPS.

The spending multiplier shows how adjustments in consumers' MPS affect the rest of the economic system. The contrary of MPS is the marginal propensity to consume (MPC), which refers to the additional consumer spending triggered by an increase in disposable income.

Calculating Marginal Propensity to Relieve

The formula beneath is used in computing MPS:

The saving changes by the value of MPS if the income changes by a dollar. MPS is equivalent to the saving function gradient. In the curve, the horizontal line (x-axis) represents a change in income, while the vertical line (y-axis) represents a modify in saving.

Points to notation about MPS:

- MPS varies between 0 and 1

- MPS = 1 if the unabridged boosted income is saved

- MPS = 0 if the unabridged boosted income is spent, indicating that changes in income have no effects on savings

Case

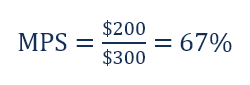

Suppose that John receives a $300 bonus with his paycheck. Information technology means that John has $300 in additional income. If he spends $100 of this marginal increase in purchasing a new pair of shoes and saves the remaining $200, his marginal propensity to save is (using the formula to a higher place):

This value is of import because MPS is non constant. Seasonal trends normally sally monthly equally margins change to heavy spending during holidays, with less active consumer spending months registering loftier saving levels. Economists use MPS in measuring the correlation between such trends to give the general economical picture of the population.

The marginal propensity to swallow differs from MPS. In the to a higher place equation, MPC is calculated as follows:

It means that for every dollar earned, 33 cents is spent on consumption while 67 cents is spent on savings. Calculation MPC (0.33) to MPS (0.67) equals to 1.

More Resources

CFI is the official provider of the Commercial Banking & Credit Analyst (CBCA)™ certification plan, designed to transform anyone into a world-class financial analyst.

In order to assistance you go a world-class financial analyst and accelerate your career to your fullest potential, these boosted resource will exist very helpful:

- Keynesian Multiplier

- Marginal Propensity to Consume

- Boilerplate Propensity to Consume (APC)

- Dispensable Income

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/marginal-propensity-to-save-mps/

Posted by: freeseterent93.blogspot.com

0 Response to "How To Find Marginal Propensity To Save"

Post a Comment